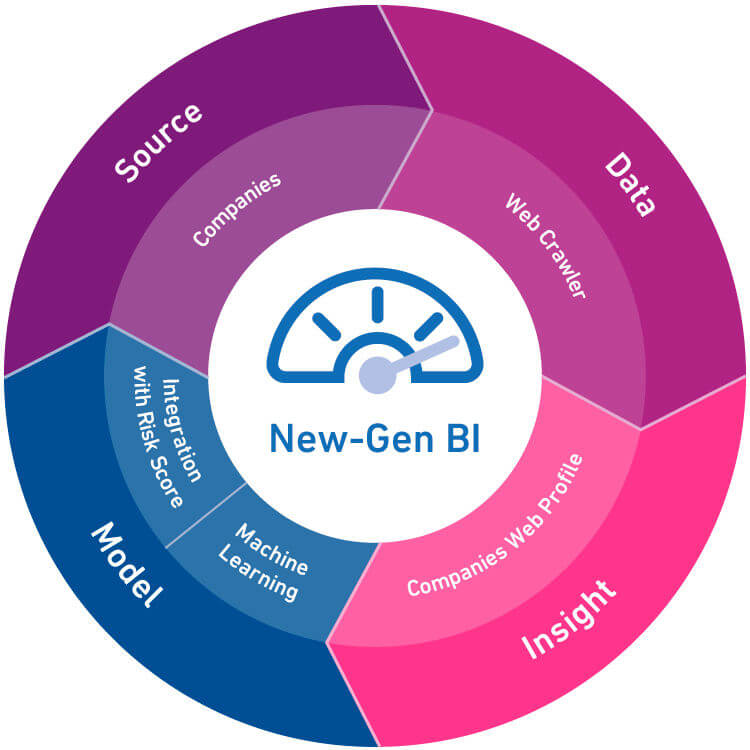

Our comprehensive end-to-end WDI solution acquires new non traditional data insights. It covers web crawling, site classification, text mining, segmentation analysis and machine learning models. Each account from a pre-defined sample is analysed, and searched for on the internet with publicly-available information collected – an automated process known as ‘crawling’ or web data scraping.

Information is then classified under various categories by sophisticated text mining algorithms, before meaningful and relevant information is converted into usable data. From there, differing text mining and sentiment analysis methods can be applied to order unstructured data and create a fresh base of predictive variables.

Web Data Insights assess customer behaviour through on-line presence measurement. It enables companies to add value to their existing matrix for portfolio evaluation.