Credit scoring solutions for your B2B and B2C customer portfolio after COVID-19

Fresh and alternative data enables accurate risk classification, fraud detection, and business and consumer customer management. What are some of the important trends that are emerging now with regard to the impact of the coronavirus on you and your client portfolio?

In a new White Paper developed by Experian Netherlands ‘Fresh Data Drives Novel Insights Post-Covid: How alternative and non-traditional web data can protect against fraud and risk and boost customer management in uncertain times’ we share the latest insights in portfolio and customer management – and why ‘fresh’ real-time alternative data is the key to:

- better risk classification

- better fraud detection

- better business and consumer customer management

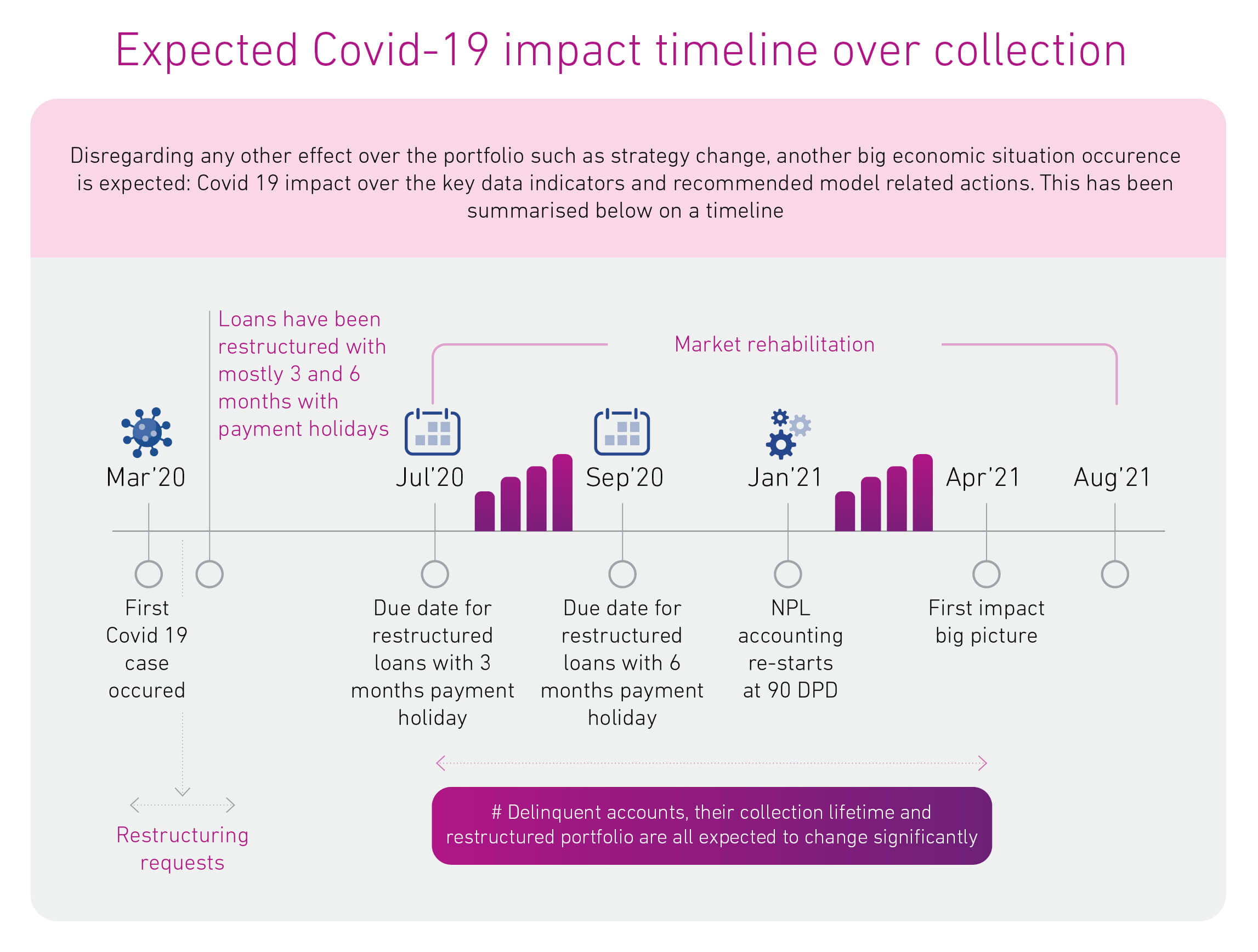

In this white paper, we highlight a variety of scenarios in which batch assessments (using Web Data Insights for business customer management and information from the Experian Consumer Credit Bureau for consumer customer management) offer fast and accurate insights into the portfolio. As payment holidays end, customer management and collections are taking on particular importance.

Download the white paper: "Fresh Data Drives Novel Insights Post-COVID"

* denotes a required field