Our 2023 insights showcase a trending shift to normalcy among SMEs in business services and consumer industries, despite economic challenges and three turbulent years

Our analysts report that the 18-month outlook for SMEs is an optimistic one. According to the 2022 State of the SME Sector Annual Report by the CBS, the Dutch economy was home to 250 thousand microenterprises, 46 thousand small enterprises and almost 10 thousand medium-sized enterprises – making up a significant number of operating businesses in the Netherlands. Dutch small businesses with 50 or less employees in a variety of sectors are showing a high level of resilience in the face of rising energy costs, inflation, and the after-effects of pandemic recovery.

Our earlier analyses still raised concerns about the ability for SMEs to bounce back after closures and business disruptions from 2020-2022. Consumer sectors are showing the strongest recovery, but we predict that default and bankruptcy risk are increasing in a number of sectors.

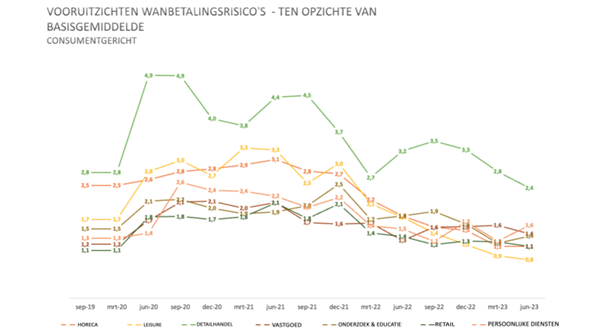

Consumer industries showed strongest recovery

The credit default risk outlook for consumer industries such as hospitality, leisure, retail, and real estate have returned to pre-pandemic levels. Business-focused services, healthcare, publishing, and finance are also nearly on par with the levels pre-2020. While bankruptcies and voluntary insolvencies continue to be reported across the Netherlands, we believe this to be a short-term effect and find overall stability and normal risk factors across most sectors where SMEs operate when looking at expectations over the next 18 months.

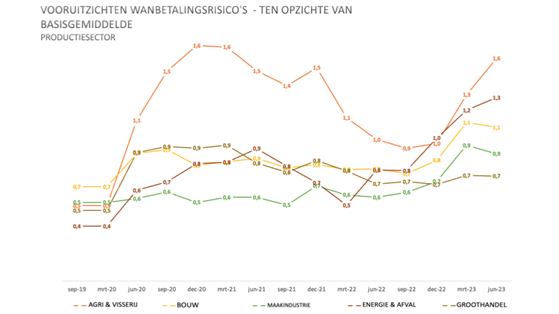

Secondary industries facing some instability

In contrast to the good news about SMEs in consumer facing sectors, secondary industries, such as agriculture, construction, and energy (classified as medium and small energy brokers in this case), are seeing a rise in credit default risk. The credit default risks for SMEs in these sectors sits closer to the risk levels at the height of the pandemic, despite earlier indications of recovery at the start of 2023. Supply chain disruption and rising energy costs are likely contributors to the impact on business operations – especially in agriculture and construction. Research by PwC Netherlands shows that Dutch producers of crops and livestock have experienced the biggest increase in production costs within the European Union (EU).

Herman Peeters, Principal Consultant at Experian Netherlands:

“For the better part of the last three years, our outlook predicted a sharp increase in default risk for SMEs in the Dutch market, heightened by the fact that SMEs would stop receiving government funding in late 2022. However, many SMEs are showing incredible resilience in the face of economic challenges, increasing energy prices, and inflation. It is critical for lenders who want to make informed decisions to have access to comprehensive data insights that show a realistic picture of the SME markets over the next few months and years. While we have heard that bankruptcies and voluntary insolvencies are on the rise this quarter, we are still nowhere near pre-pandemic bankruptcy levels. In fact, the picture for SMEs as we head into 2024 is quite optimistic.”

Using the power of data to benchmark risk

Our SME credit default risk analysis was conducted using a combination of real-time Web Data Insights showing the outlook for the next 18 months and assessment of current economic factors. Both increases and decreases in risk across sectors were measured, showing an alignment with other data sources such as the CBS.

By using and understanding responsibly collected data, lenders gain greater insight into the financial situation of SMEs. In our products, this is done by applying real-time data insights and comparing them with traditional, historical credit data. This creates a more accurate picture for lenders so they can assess potential risks in a timely manner – ultimately contributing to responsible lending.

You can find more information about Web Data Insights on our website.